Foreword -

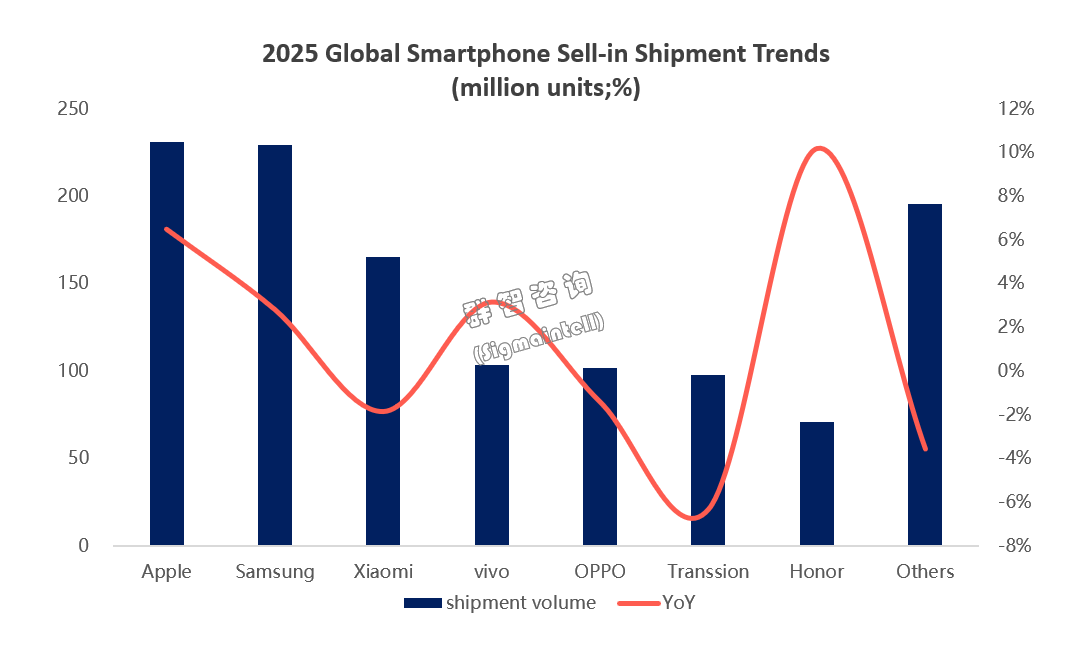

According to data from Sigmaintell, global smartphone shipments reached approximately 1.20 billion units in 2025, reflecting a year-on-year increase of 1.0%. Domestic shipments in China stood at around 280 million units, marking a slight decline of 0.2%.

Behind this overall tepid growth lies a transformation driven by cost pressures: the segmentation of price tiers, a reshaping of the competitive landscape among brands, and an evolution in the underlying logic of competition. The smartphone industry is consequently shifting from a phase of "scale competition" to a new normal of "value-depth cultivation".

The Smartphone industry is now at a critical juncture of development and transformation. Sustained high memory prices continue to exert significant cost pressure, which in turn is accelerating the optimization and upgrading of both product portfolios and supply chain strategies across the sector.

(1)Global Market: Marginal Growth with Core Driving Forces Emerging

According to data from #Sigmaintell, global smartphone shipments in 2025 reached approximately 1.20 billion units, a year-on-year increase of 1.0%. This marginal growth in the global market resulted from combined factors including premium segment breakthroughs and low-end market pressures. In terms of growth drivers, high-end models have become the core engine driving market expansion.

The global shipments of Apple in 2025 reached about 231 million units, up 6.5% year-on-year. Demand for premium smartphones remained solid worldwide. Faced with rising prices of memory components globally, Apple secured pricing and supply of key materials in advance through long-term agreements. The company has already locked in both pricing and supply volumes for core materials for the first half of 2026, establishing a significant supply advantage. It is also expected to obtain favorable pricing in the second half of the year, with suppliers prioritizing its orders.

Samsung, leveraging its vertically integrated supply chain including self-developed memory and chipset solutions, effectively mitigated supply chain risks and ensured stable production and supply. According to data from #Sigmaintell, Samsung shipped approximately 230 million units globally in 2025, an increase of 2.8% year-on-year.

Xiaomi shipped around 165 million units worldwide in 2025, down 1.8% year-on-year. As competition in the high-end market intensified, with Apple and Huawei launching new flagship models in the second half of the year, Xiaomi faced sustained pressure on its share in the premium segment. To counter cost pressures from rising global memory component prices, Xiaomi plans to strategically streamline its mid- to low-end portfolio in 2026 to protect profitability. Specific measures include scaling back certain product projects and tightening the layout of devices priced below $100.

Vivo and OPPO maintained relatively stable shipments, reaching about 104 million and 102 million units, respectively. Benefiting from supply chain synergies within key industrial clusters, both companies achieved rapid supply chain response and refined cost control amid the industry-wide trend of memory price increases.

Transsion shipped approximately 98 million units globally in 2025, a decrease of 6.3% year-on-year. Shipments in the fourth quarter alone were around 21.7 million units, down 20.0% year-on-year. As Transsion primarily focuses on mid- to low-end models, a segment with thin margins and high sensitivity to cost fluctuations, the rise in memory prices directly squeezed its profit margins, posing operational challenges.

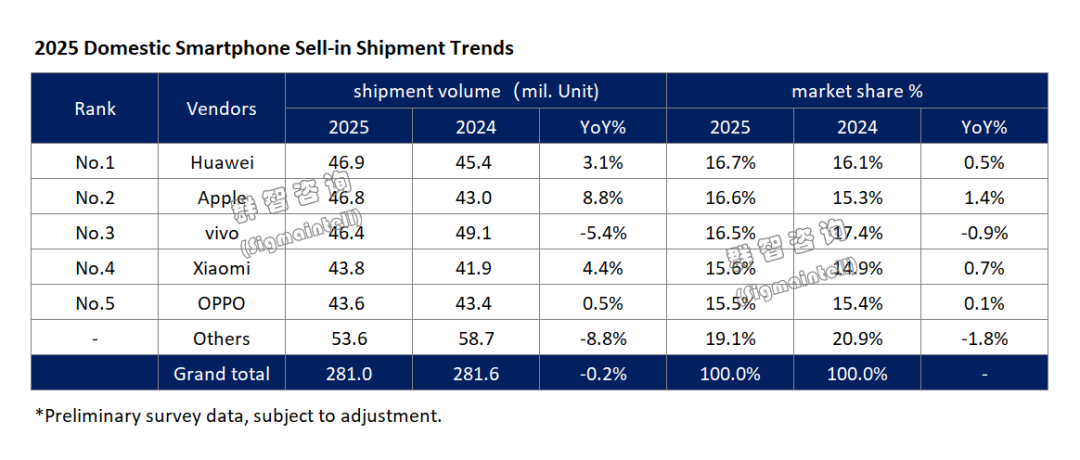

(2)Domestic Market: Fierce Competition Among Leaders and Mounting Pressure on Mid-Tier Brands

According to data from #Sigmaintell, China's domestic smartphone shipments in 2025 reached approximately 280 million units, showing a slight year-on-year decrease of 0.2%.

In 2025, leading brands launched products that combined high cost-performance advantages with substantial promotional support. Under this multi-faceted strength, the development of other smartphone brands encountered significant bottlenecks: their transition to the high-end segment was constrained by insufficient technological accumulation and a lack of brand premium, while the mid-to-low-end market continued to face profit pressure due to high costs. This ultimately hindered the growth of their overall market share.

The domestic smartphone shipments of Huawei in 2025 reached approximately 46.9 million units, making it the top player in the Chinese market by shipment volume. In the first half of the year, the performance of the Pura 80 series fell short of expectations, hampered by compatibility limitations of the HarmonyOS NEXT. In the second half, against an industry backdrop where mainstream brands generally raised product prices, Huawei promptly adjusted its pricing strategy and launched the Mate 80 series with a lower starting price. This highly competitive pricing effectively boosted its market performance, successfully securing its position as the annual shipment leader in the domestic Chinese smartphone market.

Apple shipped approximately 46.8 million units domestically in China in 2025, achieving a year-on-year increase of 8.8%. This growth was driven by the synergistic effect of six core elements: product, pricing, supply chain, channels, ecosystem, and competitive landscape.

Vivo's domestic shipments in China reached approximately 46.4 million units in 2025. Its fourth-quarter shipments stood at about 11.9 million units, which benefited from multiple positive factors, including the intensive launch of mid-to-high-end models, strong year-end promotional campaigns, and the completion of inventory clearance in the third quarter. These drivers helped vivo consolidate its shipment scale among domestic competitors and maintain its position at the forefront of the market.

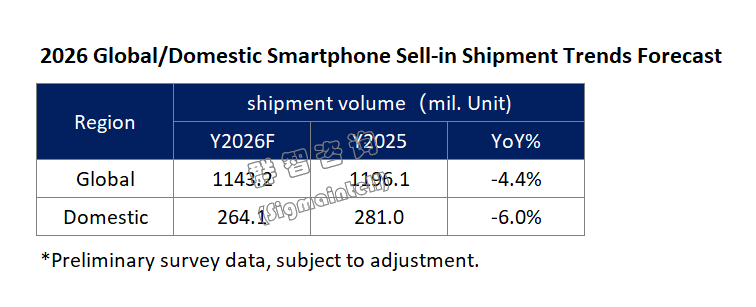

(3)Market Outlook: Navigating Both Pressures and Transformation in the 2026 Smartphone Market

According to analysis and forecasts by #Sigmaintell, global smartphone shipments are projected to reach approximately 1.14 billion units in 2026, representing a year-on-year decline of 4.4%. The trend of high memory prices is expected to persist, with cost pressures continuously being passed down to the set makers. This forces manufacturers to further optimize their product portfolios and enhance operational efficiency. For mid-to-low-end models, this may lead manufacturers to be forced into the choice of reducing memory/storage specifications or slowing down the pace of platform upgrades. In response to this challenge, some set makers may shift their long-term memory procurement strategies, moving from traditional module purchasing towards securing core raw material supplies. Concurrently, ecosystem competition has become a central battleground in the industry. The ecosystem barriers of Huawei's HarmonyOS and Apple's iOS continue to strengthen, while the comprehensive ecosystem layouts of brands like Xiaomi remain in the investment phase. Consequently, the logic of industry competition is shifting from a competition purely based on hardware specifications to a comprehensive contest of cross-device experience and service capabilities.

In the second quarter of 2025, global tablet panel shipments reached 75.9 million units, not only rising by approximately 9% quarter-on-quarter but also surging by 14% year-on-year, setting a new record for the highest quarterly shipment in the past three years. Looking at the first half of 2025 as a whole, global tablet panel shipments increased by 16% year-on-year.

Date:2025-09-08 Source:SigmaintellIn the second quarter of 2025, the total shipment volume of global flat panel reached 75.9 million pieces, increasing by 14% year-on-year. Against the backdrop of an overall upward trend in the market, the competitive landscape among panel manufacturers has also undergone significant changes. Although the concentration of market share remains at a high level, the performance of leading manufacturers has shown a clear divergence.

Date:2025-09-08 Source:SigmaintellThe global total supply of low CTE glass fiber cloth is projected to reach 6.5 million square meters in 2026, a year-on-year increase of 26%, yet Japan-dominated cutting-edge materials with <3ppm still account for 78%.

Date:2025-08-03 Source:SigmaintellIn 2024, the global shipment area of global OLED display panels surged to approximately 18 million square meters, a year-on-year increase of 36% compared to the previous year. This significant growth not only highlights OLED's dominant position in the competition of display technologies but also reflects the rapid upgrading of market demand. In sharp contrast to the slow growth of traditional LCD panels, OLED, with its characteristics such as self-luminescence, high contrast ratio, and ultra-thinness, has been widely applied in high-end smartphones, televisions and other fields, driving the steady expansion of its market share.

Date:2025-06-25 Source:SigmaintellIn 2024, the market size of OLED organic materials (including OLED terminal materials and OLED front-end materials) in China reached approximately 5.7 billion yuan, a significant year-on-year increase of 31%. Such a remarkable growth rate stems from two aspects: on one hand, the continuous expansion of the domestic OLED panel industry chain has directly driven the procurement demand for upstream organic materials; on the other hand, terminal brands' ever-increasing requirements for display quality have accelerated the penetration rate of OLED in mid-to-high-end smart terminals, further expanding the market volume.

Date:2025-06-25 Source:SigmaintellIn 2024, Chinese manufacturers' market share in the global OLED front-end materials market has reached 65%, with annual sales exceeding 2.7 billion yuan. This achievement not only reflects the comprehensive progress of domestic materials in terms of performance, stability and cost control, but also marks that Chinese enterprises are transforming from "participants" to "key drivers" in the global OLED industry chain.

Date:2025-06-25 Source:SigmaintellIn the global OLED terminal materials revenue landscape of 2024, overseas manufacturers still occupy a dominant position, with the combined market share of the top seven manufacturers reaching as high as 77%. However, it is worth noting that mainland Chinese material enterprises are rising rapidly. Their global market share in terminal materials has jumped from 1% in 2022 to 11% in 2024, showing a strong catch-up momentum. In contrast, traditional powerhouses such as South Korea, the United States, Germany, and Japan, although still holding high market shares, have seen their growth rates slow down.

Date:2025-06-25 Source:SigmaintellDespite the favorable factor of the exemption period for reciprocal tariffs in the second quarter, the growth rate of global laptop panels will slow down significantly: under a conservative scenario, the year-on-year growth rate of the overall market in Q2 will drop sharply to 1%; under an optimistic scenario, the year-on-year growth rate of the overall market will only reach 5%.

Date:2025-05-11 Source:SigmaintellIn 2024, the global shipment volume of in-vehicle display panels reached 230 million units, a year-on-year increase of 8.5%.

Date:2025-03-19 Source:SigmaintellMainland Chinese panel manufacturers' shipments of in-vehicle display panels account for 51.7% of the global market share, exceeding half for the first time. This continues to break the original market competition pattern, making them an important force driving the development of the industry. At the same time, established international manufacturers, relying on their technological and brand advantages, have maintained their positions in the market and launched fierce competition with mainland Chinese manufacturers.

Date:2025-03-19 Source:SigmaintellThe in-vehicle display panel technology will continue to show a diversified and rapidly developing situation. It is expected that the global shipment volume of in-vehicle display panels will maintain a high growth rate of 5.4% in 2025, reaching 250 million units.

Date:2025-03-19 Source:SigmaintellOLED technology has gained favor from more automotive brands due to its advantages. According to the latest statistics from Sigmaintell, the global shipment volume reached approximately 2.6 million units, more than doubling year-on-year. As an emerging technology, Mini LED has made its mark in mid-to-high-end vehicle models, with shipments of around 1.2 million units, a year-on-year increase of 41.2%.

Date:2025-03-19 Source:SigmaintellIn 2024, economic recovery and scenario innovation have jointly driven the tablet panel market to achieve an 8% annual growth.

Date:2025-02-12 Source:SigmaintellIn the fourth quarter of 2024, tablet shipments of tablet panels reached 62 million units, representing a significant 16% year-on-year growth compared to 54 million units in the same period of 2023.

Date:2025-02-12 Source:SigmaintellThe global shipment of smartphone chips in 2024 is approximately 1.21 billion, a year-on-year increase of 5.8%.

Date:2025-01-25 Source:SigmaintellIn 2024, the 4G chip market experienced a reshuffle, and the share of Ziguang Spreadtrum climbed, with a year-on-year growth of 66.7%

Date:2025-01-25 Source:SigmaintellIn 2024, the shipment volume of 4G chips experienced a decline. According to data from Sigmientell, the shipment volume of 4G chips for that year has fallen back to 400 million pieces, a year-on-year decrease of 9.0% compared to the previous year.

Date:2025-01-25 Source:SigmaintellIn 2024, the global shipment of VR optical modules was only 9.4 million units, a year-on-year decrease of 19%. Looking ahead to 2025, with the launch of more cost-effective products such as Meta Quest 3S, the VR terminal market is expected to show a trend of recovery, and it is expected that the demand for VR optical modules will gradually recover.

Date:2024-11-10 Source:SigmaintellIt is expected that the global shipment of XR image sensors will reach 50 million by 2024, a year-on-year increase of 39%. It is projected that the global shipment of XR image sensors will exceed 100 million by 2026 and is expected to exceed 250 million by 2029

Date:2024-11-10 Source:Sigmaintell